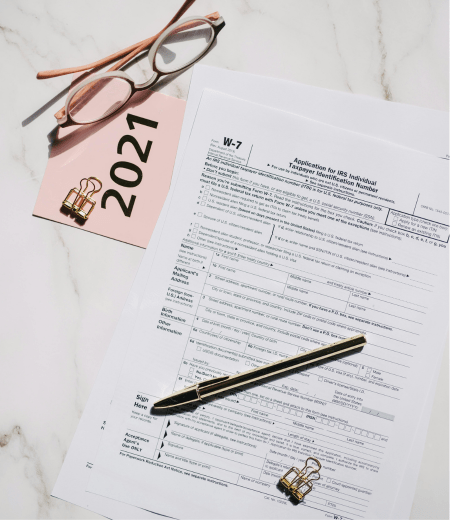

ITIN Registration

An Individual Taxpayer Identification Number (ITIN) is issued by the IRS for individuals who need to file U.S. taxes but don’t qualify for a Social Security Number (SSN). If you’re a non-resident, foreign entrepreneur, or dependent needing to meet tax obligations, an ITIN is essential.

Why Do You Need an ITIN?

An ITIN allows you to:

✔ File U.S. Taxes – Report earnings and stay compliant with IRS regulations.

✔ Open a U.S. Bank Account – Many banks require an ITIN for non-residents.

✔ Start a Business in the U.S. – Essential for foreign entrepreneurs operating in the U.S.

✔ Claim Tax Benefits – Potential deductions and tax credits may require an ITIN.

✔ Comply with Legal Requirements – Stay in good standing with federal and state authorities

Request a Service – Get Started Today!

Fill out the form below, and our expert team at US Startup Filing INC will reach out to guide you

Step 1: Submit Your Information

Provide basic details required for the application.

Step 2: We Prepare & Review Your Forms

Our experts complete your ITIN application accurately.

Step 3: Send Your Application to the IRS

We ensure proper submission for smooth processing.

Step 4: Receive Your ITIN

Once approved, you’ll get your ITIN on mailing address.

Ready to get ITIN? Contact us today and let’s get started!

Key Advantages of ITIN

File U.S. Taxes Easily

An ITIN allows you to report income, pay taxes, and stay compliant with IRS regulations, even if you're not a U.S. citizen.

Open a U.S. Bank Account

Many banks require an ITIN for non-residents to open a business or personal bank account in the U.S.

Start & Grow a Business

Foreign entrepreneurs can use an ITIN to establish a business, apply for licenses, and operate legally in the U.S.

Claim Tax Benefits & Deductions

You may be eligible for certain tax credits and deductions that require an ITIN, potentially lowering your overall tax burden.

Who Needs an ITIN?

- Non-U.S. residents who need to file a U.S. tax return

- Foreign business owners operating in the U.S.

- Dependents or spouses of U.S. citizens or residents

- International investors with U.S. tax obligations

- Individuals receiving taxable income from the U.S.

Questions & Answers For ITIN

How long does it take to get an ITIN?

Processing times vary, but it generally takes 6-8 weeks for the IRS to issue an ITIN.

Do I need to renew my ITIN?

Yes, ITINs expire if not used on a tax return for three years. We can help with renewal!

Can I work in the U.S. with an ITIN?

No, an ITIN is for tax purposes only and does not grant work authorization.

Can I open a bank account with an ITIN?

Yes, many U.S. banks accept an ITIN for account opening if you don’t have an SSN

What documents are needed to apply for an ITIN?

You’ll need proof of identity and foreign status, like a passport or national ID