Taxation

Filing the right tax form is crucial for staying compliant with the IRS and ensuring your business or personal finances are in order. At US Startup Filing INC, we simplify tax filing by handling all the necessary paperwork, ensuring accuracy, and keeping you stress-free.

Whether you’re an individual, a non-resident, a corporation, or a partnership, we’ve got you covered. Here’s everything you need to know about these essential tax forms.

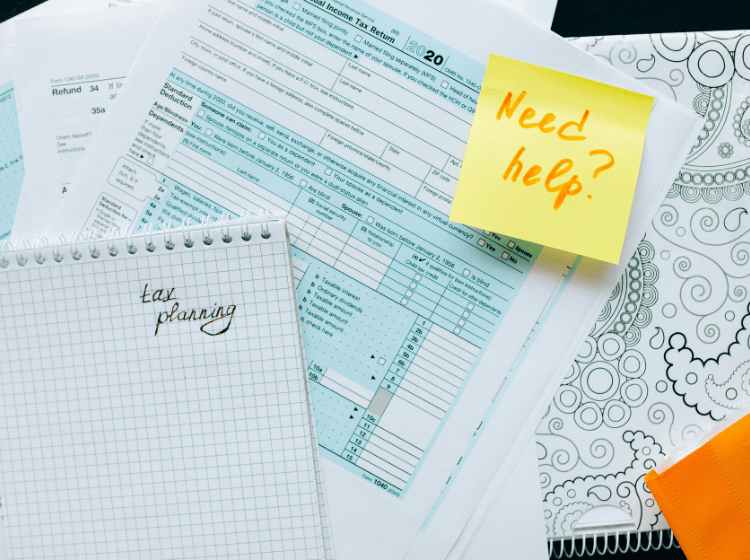

Form 1040 – U.S. Individual Income Tax Return

If you have a U.S. citizen or resident earning income, you need to file Form 1040 to report your earnings, deductions, and tax liability. It covers various income sources, including wages, self-employment income, investments, and rental earnings.

Key Features

Reports wages, salaries, business income, and capital gains.

Allows deductions and credits to reduce tax liability.

Determines refund amounts or tax due to the IRS.

Who Needs to File? Anyone earning above the IRS threshold, including employees, freelancers, and self-employed individuals.

Form 1040-NR – Nonresident Alien Income Tax Return

If you're a non-U.S. resident earning income in the U.S., you must file Form 1040-NR to report taxable income. This applies to non-residents with U.S. rental income, investments, or business activities.

Key Features

Reports U.S. income without worldwide income inclusion.

Includes tax treaty benefits for reduced taxation.

Covers rental income, freelance work, and investments in the U.S.

Who Needs to File? Non-residents earning income in the U.S., including students, investors, and business owners.

Form 1120 – U.S. Corporation Income Tax Return

If you own a C Corporation, filing Form 1120 is a must. This form reports your company’s income, expenses, and tax obligations to the IRS. It ensures your business stays compliant with tax laws and avoids penalties. Filing correctly and on time helps keep your corporation in good standing and prevents any issues with the IRS.

Key Features

Reports business revenue, expenses, and tax deductions.

Determines the corporate tax liability.

Required even if the corporation had no income.

Who Needs to File? All C Corporations operating in the U.S. must file this annually, regardless of profit or loss.

Form 1065 – U.S. Return of Partnership Income

Partnerships don’t pay income tax at the business level. Instead, profits and losses are passed through to the individual partners, who report them on their personal tax returns. To stay compliant, partnerships must file Form 1065 with the IRS. This form provides details about the business’s income, deductions, and other financials, ensuring transparency and proper tax reporting.

Key Features

Reports business income, deductions, and credits.

Generates Schedule K-1, which partners use to file their individual tax returns.

Required even if the partnership had no income or business activity.

Who Needs to File? All general and limited partnerships operating in the U.S. must file this annually.

Request a Service – Get Started Today!

Fill out the form below, and our expert team at US Startup Filing INC will reach out to guide you

Why File with US Startup Filing INC?

Error-Free Filing

We ensure accuracy to avoid IRS penalties and delays.

Maximize Tax Benefits

We help you take advantage of deductions and credits.

Dedicated Support

Our team is here to answer all your tax-related questions.